Get Coupons and Other Deals

New Customer Coupons

Save $50 on Your First Service Call * or

Get an AC Maintenance Agreement for Only $69 **

*One offer per NEW customer. Offer valid through April 30, 2024.

**Per Unit. Reg. Price $126/unit. Valid for NEW maintenance customers only. Expires April 30, 2024. ↵

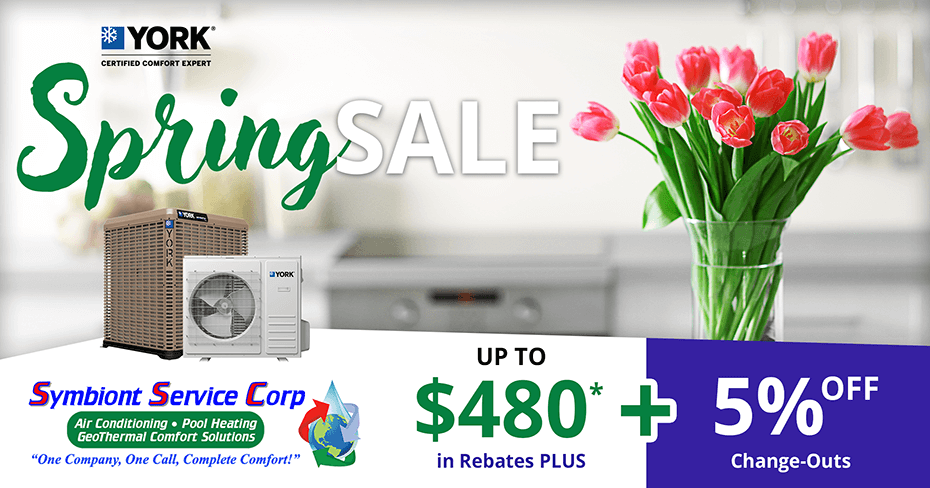

Spring 2024: York AC & Heat Pump Rebates up to $480 Plus Extended Warranty

York Spring Savings Event: AC Rebates & More!

Take advantage of the best deals on York AC & Heat Pump Systems before the summertime rush! The rebates and promotions below are valid on installations until 6/30/2024.

Save on your AC purchase with these 5 promotions:

- Up to $480 in rebates* on qualifying York equipment.

- 5% off AC changeouts: a Symbiont Service exclusive promotion!

- YORKCare™ Protection Plan: All our York units come with an extended warranty** for your peace of mind.

- Florida Power & Light’s $150 Instant Rebate†

- Federal Tax Credits††: See if your new AC or heat pump unit qualifies!

Learn More About These Amazing Offers

Claim Your Savings Today: Contact Us for a Free Quote on a YORK® Air Conditioner: 941.474.9306

*Rebates offer valid only on select York air conditioner and heat pump models purchased and installed April 1-June 30, 2024. Terms and Conditions apply. Contact Symbiont Service Corp for more information: 941.474.9306.

**With the purchase of a qualifying York air conditioner or heat pump system. YORKCare™ Protection Plan offer ends June 30, 2024. Contact Symbiont Service Corp for further information: 941.474.9306.

†To qualify for the FPL $150 instant rebate, the new AC unit must be: 1.) Installed in a residential home (excluding mobile and manufactured homes), 2.) A completely new A/C system, including both indoor and outdoor units, 3.)16 SEER or 15.2 SEER2 rated and above, and 4)Installed through an FPL Participating Independent Contractor (PIC) (like Symbiont Service Corp). Learn more at FPL.com.

††DISCLAIMER: The tax credit information contained within this website is provided for informational purposes only and we do not guarantee the accuracy of the information provided. It is not intended to substitute for expert advice from a professional tax/financial planner or the Internal Revenue Service (IRS). Symbiont Service Corp does not offer tax advice. We recommend you talk to your accountant or other tax professional. For the most up-to-date information on federal tax credits, please visit energystar.gov and IRS.gov.

30% Federal Tax Credit on GeoThermal Heat Pumps

Saving Americans Money on Renewable Energy Improvements

What is the Tax Credit?1

The renewable energy tax credit covers 30% of the total system cost, including installation, of GeoThermal heat pumps meeting the requirements of the ENERGY STAR program. Under the Inflation Reduction Act in August 2022, the GeoThermal tax credits have been extended through December 31, 2034. The 30% tax credit may also be retroactively applied to GeoThermal systems placed in service on January 1, 2022, or later.

Residential Tax Credit

You’ll want to act soon to save the most on Your GeoThermal installation. The 30% tax credit will reduce to 26% in 2033, then to 22% in 2034, before it expires altogether.

| 30% Tax Credit through 2032 |

26% Tax Credit through 2033 |

22% Tax Credit through 2034 |

Commercial Tax Credit

The commercial tax credit is extended under a two-tier structure:

- A “base rate” of 6% (or 1/5 of the bonus rate)

- A “bonus rate” of 30%

The tax credit will reduce in 2033 and again in 2034, so you will want to act soon to make the most of the available savings.

Credit for commercial geothermal installation rates:

| 30% Bonus / 6% Base through 2032 |

26% Bonus / 5.2% Base through 2033 |

22% Bonus / 4.4% Base through 2034 |

How Do I Apply?

To claim residential tax credit, fill out IRS Form 5695 and file it with your tax returns. The 2022 form 5695 has not been released yet, but you can get the 2021 Form 5695 here. If you have already filed your return, you will need to file an amended return (Form 1040X) to claim these credits. Save your receipts and the Manufacturer’s Certification Statement2 for your records. Please contact the IRS directly, or talk to your tax professional, with questions on how to file.

To claim the commercial tax credit, consult with your tax professional, or contact the IRS directly.

Learn More about the GeoThermal Federal Tax Credit

Call Symbiont Service for a Free Quote on a GeoThermal Air Conditioning System. 941.474.9306

1 Disclaimer: The tax credit information contained within this website is provided for informational purposes only and is not intended to substitute for expert advice from a professional tax/financial planner or the Internal Revenue Service (IRS). The information was adapted from documents published by GeoExchange and WaterFurnace following the passage of the Inflation Reduction Act in August 2022. Statements on this page are being finalized by the federal government and are subject to change and interpretation. To understand what you qualify for, please see your tax professional.

2 A Manufacturer’s Certification Statement is a signed statement from the manufacturer certifying that the product or component qualifies for the tax credit. Manufacturers should provide these Certifications on their website. Call the manufacturer, or search their website. EPA does not have copies of the Manufacturer’s Certification Statement. Taxpayers must keep a copy of the certification statement for their records, but do not have to submit a copy with their tax return.